- April 15, 2024

- Posted by: Intrinsic Value

- Categories: cyclical investing, Economics, Investing strategy, value investing

Whenever Investors hear War, they hear uncertainity. they predict huge corrections, they think about halting/stopping their investments but is War really a good reason to Panic??

Lets dissect this-

While it might seem intuitive to assume that wars would greatly impact financial markets, historical data suggests otherwise. Surprisingly, markets often exhibit resilience and adaptability even in the face of conflicts.

Below is the list of major Terror/War related events in last 40-50 years-

1971- Bangladesh Liberation War

1984- Operation Blue Star

1984- Assassination of Prime minister

1990 – Gulf War

1999- Kargil War

2001 – WTC Attack

2003 – Iraq War

2017- US- Iran Escalation

2018 – Trade Wars

2022- Russia –Ukrain War

2023- Isreal- Palestine

and now we are on the verge of Escalation between Iran- Israel.

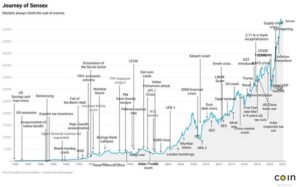

Below is the chart of sensex for last 44 years.

(Chart provided by Coin,zerodha)

In long term, wars or related events dont affect the market. the only thing that affect the market is Business financials and economy.

But what about short term, Can we halt/Stop investing for short period of time in war and continue when the markets are more certain?

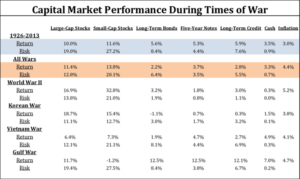

Historically speaking, Wars have not affected the market in short term also. Giving you one more insight on wars and capital markets, this time from USA markets.

On an avg, stocks have given double digit returns in all the War years. This is not an implication that in future, markets can not correct. It means Even though the market corrects, it wont be because of war.

One more interesting snippet related Kargil war:

Nifty rallied 41% during war and continued to rally after that.

Stock market is filled with such examples where Markets have exhibited resilience and adaptability even in the face of conflicts. Here’s why this happens:

- Market Anticipation: Markets are forward-looking and often anticipate potential conflicts, factoring them into prices before they occur. This means that much of the impact is already priced in by the time hostilities begin.

- Diversification: Modern investment portfolios are typically diversified across various asset classes and geographies. This diversification helps mitigate the impact of localized events such as wars on overall portfolio performance.

- Government Intervention: Governments and central banks often intervene during times of crisis to stabilize financial markets. They may implement monetary policies, provide liquidity, or enact other measures to prevent excessive volatility.

- Technological Advances: In today’s interconnected world, technology plays a significant role in mitigating disruptions caused by conflicts. Digital infrastructure allows businesses to adapt quickly, maintain operations, and find alternative supply chains.

- Investor Sentiment: Investor sentiment can play a significant role in market movements during times of conflict. While initial reactions may be negative, markets tend to recover as investors regain confidence in the resilience of the economy and adapt to the new geopolitical landscape.

I happened to mention before “Markets can correct, but it wont be because of War”. Lets understand this.

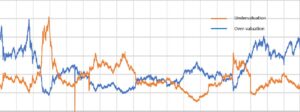

Our In-house Intrinsic Valuation index which looks at the long term Under/Over valuation of the market looks like this in current market.

The divergence shows the magnitude of overvaluation market is in right now. Although it has continued the momentum from last 3-4 years or so, it is investors responsibility to find the right pockets to put their money into. Not everything will work from here, unlike 2020 market.

So which are those pockets.

There are multiple ways to look at investing strategies but here i am going to talk about the sectors which are going to get affected as per the BJP election manifesto.

Although no one used to take manifestos seriously in our country, people have started to listen what govt. is saying in recent years. Primafacia, people are expecting BJP govt again so we have analysed their manifesto and tried to figure out which sectors should be in focus for next 5-10 years.

You should check Quality companies at reasonable valuation in these sectors to reap the benefits of Govt steps. You should also learn how to find potential 10X opportunities from one of our videos as it will help find some common traits between potential multibaggers.

***

About Author-

Nikhil Gangil is a SEBI registered Research analyst, founder of Intrinsic Value Equity Advisors, IIT Madras alumnus and a value investor. His strength is to find well-growing companies at wonderful valuations.

Followe him on twitter

Nice Read, very nicely expressed and correlated.