- July 11, 2020

- Posted by: Intrinsic Value

- Category: Uncategorized

The stock market is a device for transferring money from the impatient to the patient.”

– Warren Buffett

Hey Guys,

We hope that you are safe and sound. Welcome to post COVID times (i think). Since the Lock-down period was from Apr to Mid June, Earnings will definitely fall for a lot of Core businesses due to No/Very less Production. We anticipate at least a quick moderate jolt to the index if not a big correction.

It is a time to be very stock specific and focus on undervalued segment. One of which is small Cap/Mid Cap. It has been Undervalued since 2018-19 and now widening its wings with support of lots of smart money getting invested. There are two reasons small Cap should rise now.

1. Index companies/ Large caps are still Overvalued. One Jolt and it can loose us Big chunk of our investments. PE of Nifty is near 29 which is not safe at all.

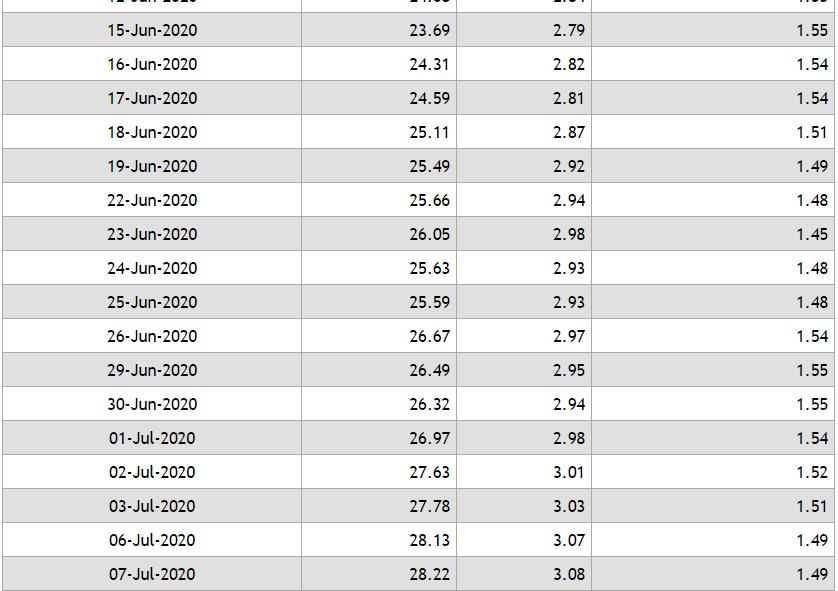

PE ratio of Nifty in last 20 Days

PE ratio of Nifty in last 20 Days

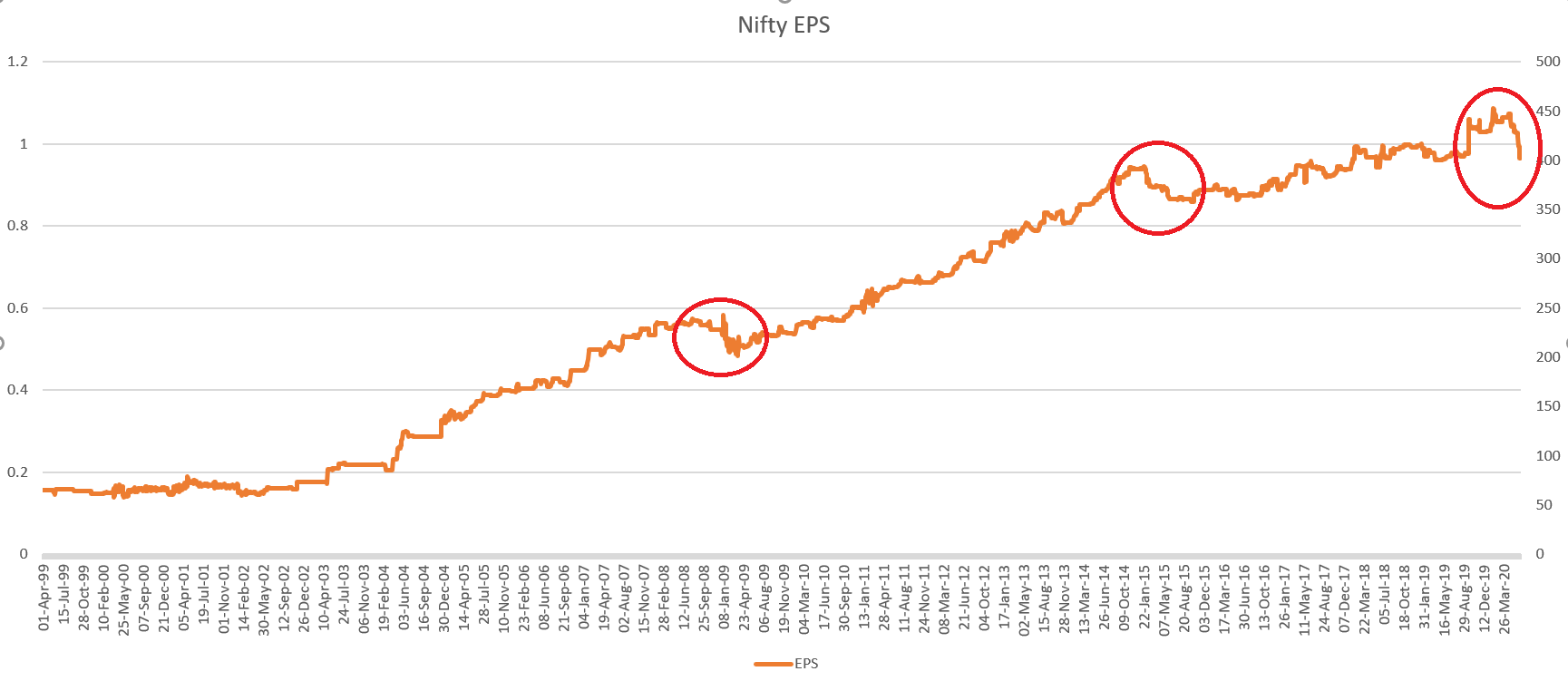

Sharpest EPS Fall in 21 years of Nifty history

Sharpest EPS Fall in 21 years of Nifty history

2. Big investors may soon shift big chunk of the investments to the undervalued small cap businesses which are doing very good. If it happens, It will boost the sentiments in small cap and Large cap investors have to wait for 2-3 years to see any profit in their portfolios. It’s a very common cycle, happens all the time.

Having said that, we have to be very careful in selecting small cap companies too. Focus has to be on continuous performing companies but with best valuation.

Here are some of the worth investment and their fundamentals we have found so far for us to invest.

POWER MECH PROJECTS-

Sector- Engineering and Construction

Promotor Holding- 62.5%

Earning Yield- 18.9%

Book Value-647

Return on Capital Investment- 23.55%

Min Intrinsic / BUYING Price – 472

VIDHI SPECIALITY FOOD –

Sector- Synthetic Food Colours and Chemicals

Promotor Holding- 64.27%

Earning Yield- 9.41%

Book Value- 25.8

Return on Capital Investment- 33.36%

Min Intrinsic / BUYING Price – 59

VINDHYA TELELINKS-

Sector- manufacturing and sale of telecommunication Cables

Promotor Holding- 43.54%

Earning Yield- 28.2%

Book Value-2035

Return on Capital Investment- 15.31%

Min Intrinsic / BUYING Price – 641

MAHINDRA LOGISTICS-

Sector- Supply Chain Management (SCM) and People Transport Solutions (PTS)

Promotor Holding- 58.45%

Earning Yield- 2.3%

Book Value-76.10

Return on Capital Investment- 17.74%

Min Intrinsic / BUYING Price – 326

CHEVIOT-

Sector- Jute Products

Promotor Holding- 74.99%

Earning Yield- 12.5%

Book Value-963.63

Return on Capital Investment- 12.57%

Min Intrinsic / BUYING Price – 431

DELTA CORP-

Sector- Casino/Gaming

Promotor Holding- 32.77%

Earning Yield- 7.4%

Book Value-72.14

Return on Capital Investment- 15.71%

Min Intrinsic / BUYING Price – 86

VST INDUSTRIES-

Sector- Cigarettes & Tobacco

Promotor Holding- 32.16%

Earning Yield- 6%

Book Value-509.7

Return on Capital Investment- 41.89%

Min Intrinsic / BUYING Price – 3177

ATUL AUTO-

Sector- Three Wheeler manufacturer

Promotor Holding- 52.70%

Earning Yield- 14.25%

Book Value-138.2

Return on Capital Investment- 33.42%

Min Intrinsic / BUYING Price – 163

NAVA BHARAT VENTURES-

Sector- Power generation/Mining/Manufacturing

Promotor Holding- 46.3%

Earning Yield- 39.4%

Book Value-237.5

Return on Capital Investment- 15.81%

Min Intrinsic / BUYING Price – 47

HINDUSTAN MEDIA VENTURES-

Sector- Media

Promotor Holding- 74.4%

Earning Yield- 30.8%

Book Value-205.9

Return on Capital Investment- 8.31%

Min Intrinsic / BUYING Price – 53

FEDERAL BANK-

Sector- Bank

Promotor Holding- –

Earning Yield- 14.6%

Book Value-74.34

Return on Capital Investment- 6.38%

Min Intrinsic / BUYING Price – 49

And yes, Do not forget the only Mantra in value investing. “CASH, DISCIPLINE & PATIENCE”

REGARDS,

INVEST WITH US

Be Greedy when everyone else is Fearful, Be Fearful when everyone else is Greedy.