- June 8, 2025

- Posted by: Intrinsic Value

- Category: Uncategorized

1. Objective

The GAWP Index (Gangil Age Wealth Parity Index) aims to provide a revolutionary, age-adjusted framework for evaluating an individual’s net worth. Instead of comparing absolute wealth, which leads to poor self-evaluation and misleading pride, GAWP offers a fair lens: What does your net worth mean at your age?

This tool’s primary goal is to:

- Stop toxic comparisons between different age groups.

- Offer motivation to young achievers who feel “behind.”

- Give a reality check to older individuals misjudging their preparedness.

- Serve as a psychological and financial planning tool.

2. Why the GAWP Index is the Need of the Hour

The Modern Wealth Crisis Is Psychological

In today’s fast-paced world, wealth isn’t just about numbers — it’s about perception. Social media, startup culture, and publicized billionaire success stories have warped the financial mindset, especially for the youth.

Two major mental mismatches GAWP addresses:

a) Young People with Low Confidence

A 25-year-old with ₹50 lakhs Networth feels like a loser, not knowing they are already ahead of 99.5% of Indians. Without context, this leads to:

- Chasing “get rich quick” traps.

- Taking unnecessary financial risks.

- Depression or hopelessness.

🧠 Example: ₹50 lakhs at age 25 growing at 15% CAGR becomes ₹1089+ Cr by age 80. But many quit halfway due to short-term inferiority.

b) Older People with False Confidence

A 70-year-old with ₹3 Cr feels safe. But if we backtrack to age 25, this wealth is equivalent to just ₹6 lakhs in today’s terms.

This false sense of comfort leads to:

- Under-preparation for medical or lifestyle emergencies.

- Over-gifting assets to heirs.

- Lack of insurance, backup planning, or cash flow buffers.

3. Methodology and Calculation

The GAWP Index works on a simple principle: Every rupee has a different value depending on the age of the person holding it.

🔁 How it works:

- We assume a standard CAGR of 15% for everyone’s wealth until age 80.

- We back-calculate your future net worth at 80.

- Your future value decides your badge.

🔢 Formula:

Future Wealth = Present Net Worth × (1 + 0.15) ^ (80 – Present Age)

This provides a consistent way to compare a 25-year-old and a 75-year-old without bias.

🔁 Terms and conditions:

1. Networth = (Assets- Liability )

2. Asset will not take 1st home in account, however If you have a loan on that property, it counts in liability because you can not use the first house in wealth building but you will have to clear the loans just to be able to live in it

3. For an example, an individual have house worth 1 crore, Loans worth 70 Lakhs and Cash and Liquid investments worth 80 Lakhs. It means his Networth is 10 Lakhs (80Lakhs- 70 Lakhs)

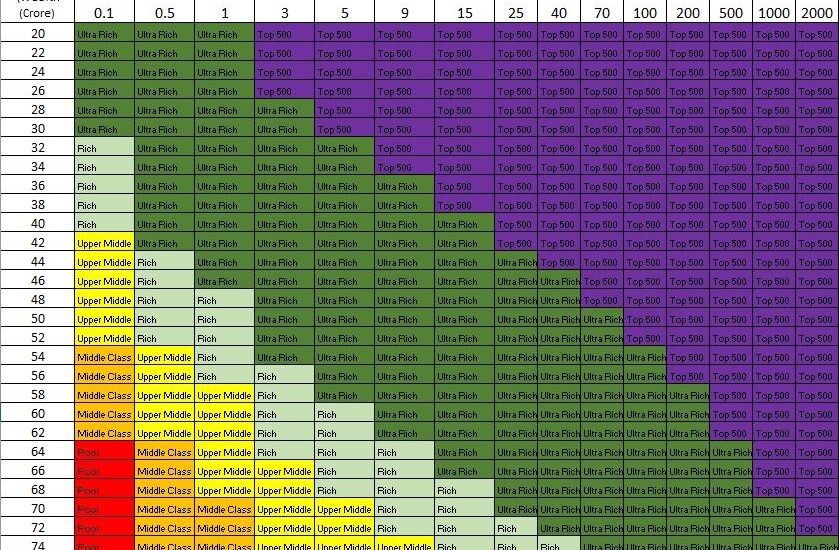

4. Badges – Classifying the Wealth

We define 6 clear categories based on the future projected net worth (at age 80):

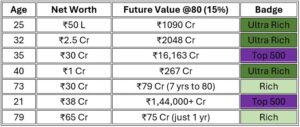

5. Examples

Notice the contrast: A 25-year-old with 50 Lakhs is far ahead of an 79-year-old with 65 Cr.

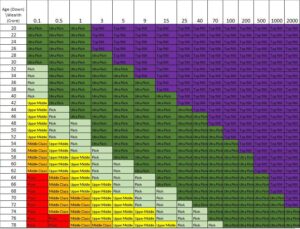

6. GAWP chart

It may look ridiculous at first because I have never seen a 30 yr old with only 10 Lakh INR saving call himself Ultra Rich but that is where he is wrong because he is not realizing the wealth he has i.e. the wealth of Age. But a person who is 78 doesn’t have that so he is indeed poor.

Similarly a 52 year old gentle man can have a panic induced by his net-worth as small as 50 Lakhs but this chart indicates that he can still be saved as a Rich class if he can just invest this money the right way and create 15% CAGR for next 30 years.

Removing these panics from common people’ s life is the task of GAWP index. Because such panics push common people into FOMO and push them into “Get rich quick” scams.

Second goal of this index is to give a reality check to those with higher salary but Nil saving/ Net-worth but believe they are Rich. So that they don’t end up Poor in their 70s.

7. Benefits and Real-World Use Cases

a) For Individuals

Understand your real position. Feel inspired, not inferior. Avoid flashy shortcuts and stay on the path of compounding.

b) For Advisors

Help clients reframe goals realistically. Don’t treat a ₹2 Cr client the same way at 30 and at 70.

c) For Mental Health Professionals

Use it as a therapy tool to fight wealth-induced inferiority or overconfidence.

d) For Fintech Tools

Embed the index in dashboards to help people track net worth with age context, not in isolation.

8. Future Development

We plan to:

- Launch an interactive web tool.

- Add AI benchmarking across Indian cities or career groups.

- Introduce custom CAGR simulations for advanced users.

- Publish the GAWP Whitepaper in global platforms and IIT clubs.

9. Conclusion

GAWP is not just a tool. It’s a reality check. It is designed to:

- Kill anxiety.

- Kill ego.

- Replace envy with inspiration.

- Replace comfort with caution.

You are not behind. You are not ahead. You are where you are — when you are.

The world needs this. India needs this. You need this.

Author

Nikhil Gangil

Founder/CEO, Intrinsic Value Equity Advisors

Equity Research analyst

IIT Madras alumni